5 Small Business Essentials to Be More Professional & Trustworthy

Whether you’re just starting out as a sole trader, or you run a limited company, we need some basic ‘admin’ foundations to ensure our business is professional and trust-worthy.

I’m sharing five things that are super important to ensure your business runs smoothly and you gain the respect of your customers. Sometimes life just gets in the way and we forget to set these things up, so this is your sign to get cracking!

Table of Contents

Watch this on YouTube or keep scrolling to read:

1. Get a professional email address

What I mean by this is an email address that uses your domain, and is customised to your business. For example, byrosanna.co.uk is my domain (it’s linked to my website!), and my email address is therefore contact@byrosanna.co.uk.

You can have anything you like before the @yourdomain.com, for example ‘hello@’ or ‘yourname@’, but the difference between a professional email address and a personal email address is the use of a custom domain at the end.

A personal email address usually looks something like these:

katylovescats123@gmail.com

jack1995@hotmail.com

sophiesalter64@outlook.com

^ These are fine to use for your personal, day to day emails, but they don’t look very professional if you’re sending emails from them to your customers & clients.

Having a professional email address makes a WORLD of difference in how you come across to people. It shows that you take your business seriously, and appears more trust-worthy as well.

It’s easy to set one up, even if you don’t have a website or domain yet. For example, you can buy a domain with a company like Godaddy and set an email address up with them for as little as £3-4 per month.

2. Keep track of your finances with a bookkeeping software

Regardless of how your business is set up (perhaps you’re a sole trader, or maybe a Limited company), it’s essential to keep track of your business finances so that you can see how much you’re making and spending in your business.

To do this, you can use a bookkeeping software, which will keep track of everything for you. I use Quickbooks for this, and it syncs up with my business bank account - Starling. It’s important to have a separate bank account for your business transactions too, that’s totally different to your personal bank account - again you can do this as a sole trader OR a Limited company!

At the end of each month I just need to go in and match up all my outgoings with my expense receipts, and all my income with my client invoices. When tax return season comes around you can then either file your accounts yourself, or hand over your bookkeeping software to an accountant to do that part for you.

3. Protect yourself with business insurance

Depending on what kind of business you run and the activities you do, you may need some kind of business insurance to protect you against legal claims, loss of earnings and so on.

For example, if your business involves you going out and running events or getting hands on with clients, you’re likely to need public liability insurance.

Or, if you have an online based business, even though you may not need public liability insurance, you may want to get professional liability insurance to protect you if you get sued by customers or clients, and to cover loss of earnings if you get sick.

You’ll want to do some research into the type of insurance you need for your exact business.

4. Ensure your website is legally compliant

I’m always surprised by how many businesses (both big and small!) don’t know about what to include on a website to ensure it’s compliant with various data protection laws!

One of the main things your website needs is a GDPR compliant Privacy Policy which is tailored to the activities your business does. You can get one either by consulting a legal professional, purchasing a template online and customising it, or paying a third party software to generate a policy for you.

I personally use Iubenda, because they also create a compliant Cookie management system for your website as well! It’s super easy to add to your website once you’ve signed up. You can get 10% off your first year by signing up with my affiliate link: http://iubenda.refr.cc/9M2BKKS

Further reading: Is your website legal?

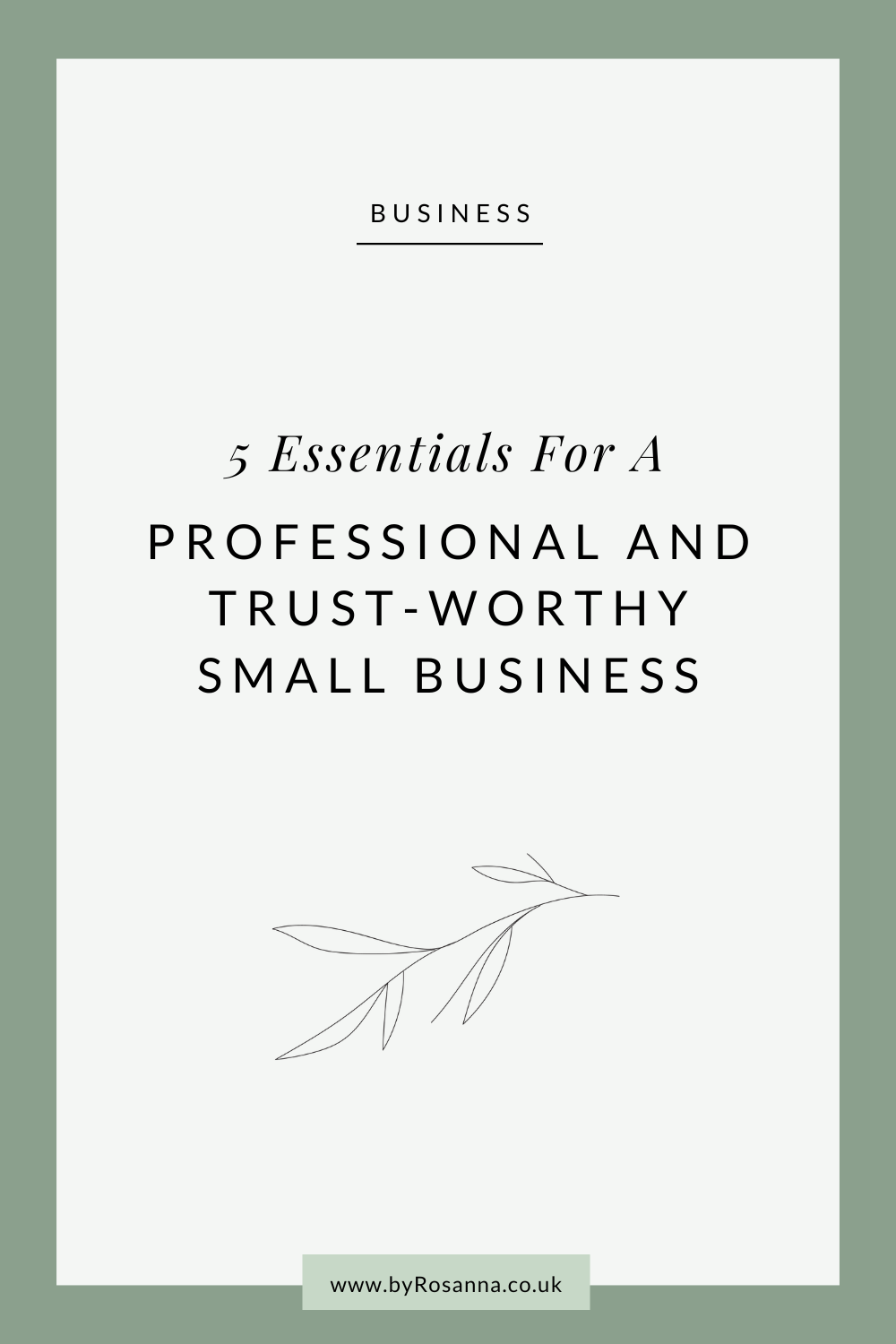

5. Be confident about your pricing

Are you worried you’re charging too much? Or perhaps you don’t know if you’re charging enough? Pricing your services can be really difficult, and it’s easy to worry and compare yourself to other people in the market.

But until you get really clear about your prices and how to package them, and you feel truly confident in this, you can’t expect your clients to feel confident in them either.

If you want to learn how to:

Find your minimum hourly rate

Decide whether to charge by the hour or a fixed rate

Price based on value

Display your prices in the best way

Decide whether to put your prices on your website or not

Check out my 60 minute ‘How to Price Your Services’ masterclass! It’s a pre-recorded, downloadable video training so you can watch whenever suits you, and comes with a Pricing Spreadsheet Calculator to help you find your minimum rates.

+ Bonus! Back up your business

Even if your business isn’t solely online-based, chances are you have some really important files on your computer, or perhaps a fancy website to display your services & products, that would cause a HUGE issue if you lost them.

Therefore it’s imperative to have a regular system for backing up your stuff! Whether that’s using cloud storage, an external hard drive, or both, you need to keep your business assets SAFE!